What's going on with crypto?

What's going on with crypto?

Cryptocurrencies are undergoing their second winter after cryptos like BTC and ETH have reached their all-time high, and the price of almost every top coin is now worth half or even less. For many, these are challenging times, but others see this market correction as a great time to "buy the dip."

But here the question is... Why did cryptocurrency markets crash in the last months?

What is important are the events worldwide that have caused not only cryptocurrencies to decline in value but also many of the most important stocks, such as Netflix, Tesla, and Meta fell. Even the Standars and Poor's 500, most commonly known as the S&P 500, is having its worst year in six decades.

Cryptos have gone into a downturn as a result of:

1. The US Federal Reserve's decision to raise interest rates

Last month, the US Federal Reserve announced its plan to boost interest rates by 0.75% to cool down the rising, red-hot inflation rate. When the Fed raises the federal fund's target rate, the goal is to increase the cost of credit throughout the economy. As mentioned in Forbes, "Higher interest rates make loans more expensive for both businesses and consumers, and everyone ends up spending more on interest payments. Those who can't or don't want to afford the higher payments postpone projects that involve financing. It simultaneously encourages people to save money to earn higher interest payments. This reduces the supply of money in circulation, which tends to lower inflation and moderate economic activity—a.k.a. cool off the economy".

In conclusion, it is sought that there is less money in circulation so that there is not as much demand, and supply can be regulated since we know that inflation is an effect when the demand overcomes the supply in products or services.

Even though on this last occasion, the rise in interest rates had a positive impact on the price of some of the cryptocurrencies, it is evident that in the long term, the reduction in spending (as a result of the rise in interest rates) triggers an investment reduction. According to data from CoinMarketCap, since the US FED started raising interest rates, the price of Bitcoin has fallen by 40 percent.

In these circumstances, people sell their riskiest assets and look for safer investments, such as Treasury bonds or the dollar.

The Ukraine war

The first war that occurred in the rise of cryptocurrencies has had a significant impact on the price of these. "The crisis in Ukraine is causing many investors to sell their shares and other investment assets, which drives down the prices of those assets throughout the market. The same thing is happening with cryptocurrencies: investors are selling," said ElDiario.es.

However, the Ukrainians have rapidly adapted, especially with cryptocurrencies, since restrictions on withdrawals and bank transactions have been imposed in their territories. In addition, the Ukrainian government has used these types of assets to finance the war, obtaining economic resources. As mentioned by the economist, "By the beginning of March, Ukraine's government had already spent over half of the crypto it had raised on military equipment including medicine, ballistic plates for bulletproof vests, walkie-talkies, lunches for soldiers, thermal imagers, and helmets. Around a fifth of the funds raised has been spent in crypto directly."

Investors worldwide are concerned about the global economy, soft fiat currencies, and geopolitical tensions. Ultimately, the outlook remains uncertain.

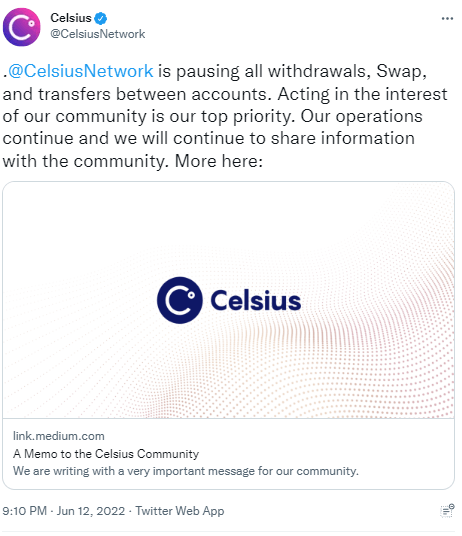

Celsius announcements

Through an announcement, the Celsius Cefi platform mentioned that due to the market's conditions, the platform temporarily paused withdrawals, exchanges, and transfers between accounts. This decision alerts many users and raises fears that some of the largest companies in the sector are currently going through an unstable financial period. This news caused a sharp drop in cryptocurrencies, reaching the lowest prices in the last 18 months.

Previously, this platform offered relatively high returns to investors, offering an APY of up to 30%. However, these investors do not have the protection of the Federal Deposit Insurance Corporation due to the unregulated nature of crypto platforms

Celsius has not yet been reported against the schedule to reopen temporarily paused services. They mention that they are working hard to fulfill their obligations.

Last thoughts…

We have always been aware that the volatility of cryptocurrencies has been highly influenced by global events, which affect their price.

Even though we are currently daring a "crypto winter," the outlook for many people is still very encouraging for the future. For other people, this fall is quite challenging to recover. The future is uncertain, but we know that crypto is here to stay. What do you think will happen to the market?